Making Green Hydrogen is About to Become a Little Easier

- Author: M.Leshchiner

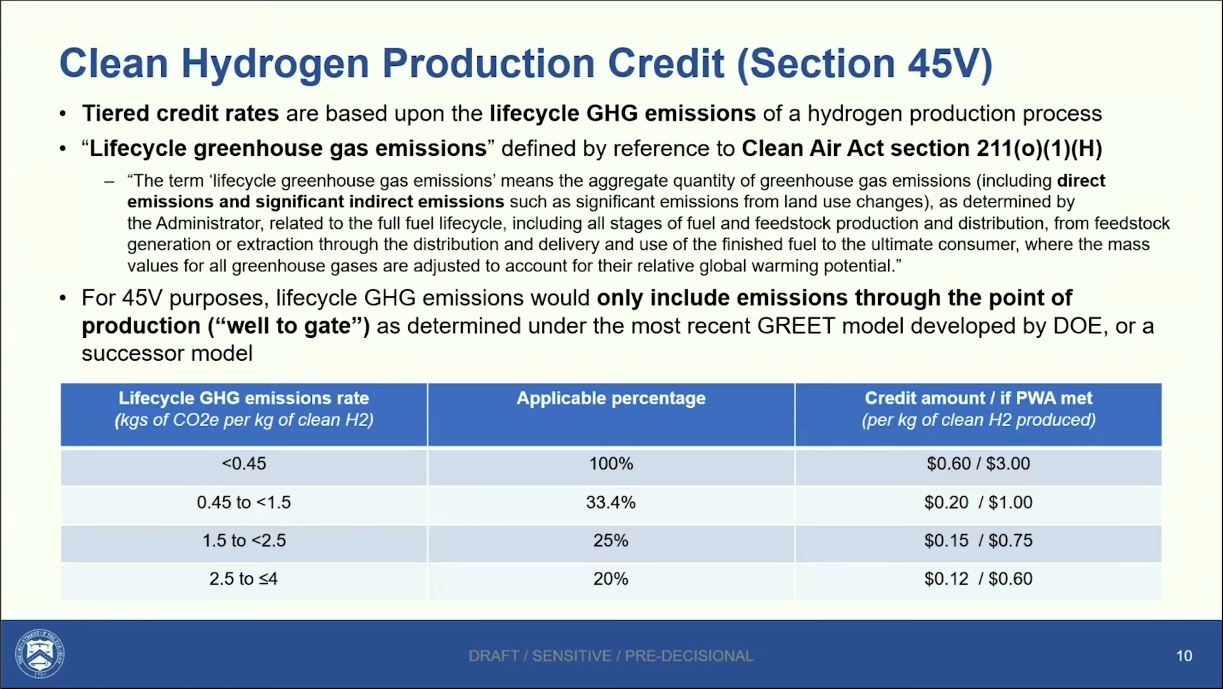

On December 22, 2023 U.S. Department of the Treasury and IRS released proposed guidance on clean hydrogen production credit to drive American innovation and strengthen energy security. The proposed regulations for hydrogen tax credits under Internal Revenue Code Section 45V address fundamental rules for claiming the Clean Hydrogen Production Tax Credit established under last year’s Inflation Reduction Act.

“Today’s announcement will further unprecedented investments in a new, American-led industry as we aim to lead and propel the global clean energy transition,” said U.S. Secretary of Energy Jennifer M. Granholm. “Hydrogen has the potential to clean up America’s manufacturing industry, power the transportation sector and shore up our energy security all while delivering good-paying jobs and new economic opportunity to communities in every pocket of America.”

The Section 45V tax credit provides a tax credit of up to $3 per kilogram of hydrogen to projects with low lifecycle greenhouse gas emissions. The proposed regulation is not final yet, with public comments accepted until February 26, 2024. Public Hearing is scheduled for March 25, 2024.

In this article I will try to highlight the fundamentals of the proposed regulation, as I understand them.

- On 12/22/2023 Treasury and IRS issued Notice of Proposed Rulemaking (NPRM) proposing regulations on the section 45V tax credit

- The hydrogen production tax credit is expected to last for 10 years. It is available for qualified clean hydrogen produced at facilities beginning construction before January 1, 2033

- Hydrogen must be produced in the United States for sale or use and it must be verified by unrelated third party

- The amount of tax credit depends on carbon intensity or hydrogen lifecycle greenhouse gas emissions

- There are four tax credit tiers:

- 4.0 – 2.5 kg CO2 equivalent per kg H2; Tax credit $0.60/kg H2

- 2.5 – 1.5 kg CO2 equivalent per kg H2; Tax credit $0.75/kg H2

- 1.5 – 0.45 kg CO2 equivalent per kg H2; Tax credit $1.00/kg H2

- < 0.45 kg CO2 equivalent per kg H2; Tax credit $3.00/kg H2

Credit amounts above assume 5x multiplier for meeting prevailing wage and apprenticeship requirements

- Tax credit is production technology agnostic, in other words it is independent of the hydrogen production path

- Lifecycle GHG emissions is the cornerstone of the proposed regulations. It will determine the tax credit tier. Proposed regulations and IRS eligibility are based on the specific method for accounting for the Lifecycle GHG emissions

- Lifecycle GHG emissions are determined by the most resent GREET (Greenhouse gases, Regulated Emissions, and Energy use in Technologies) model. The most recent version is 45VH2-GREET, which is accepted by IRS as a basis for emissions evaluation.

- 45V defines lifecycle emissions as “Well-to-gate”, which means everything from feedstock sourcing to the point of hydrogen production. It is specifically tied to the Renewable Fuel Standard and Clean Air Act section 211(o)(1)(H).

- 45VH2-GREET currently includes 8 Hydrogen Production Pathways for evaluation.

- Steam methane reforming (SMR) of natural gas, with potential carbon capture and sequestration (CCS)

- Autothermal reforming (ATR) of natural gas, with potential CCS

- SMR of landfill gas, with potential CCS

- ATR of landfill gas, with potential CCS

- Coal gasification with potential CCS

- Biomass gasification with corn stover and logging residue with no significant market value, with potential CCS

- Low-temperature water electrolysis using electricity

- High-temperature water electrolysis using electricity and potential heat from nuclear power plants

- If hydrogen production pathway is different from the list above, a producer cannot use GREET model and needs to obtain a provisional “lifecycle emissions value” from DOE. Although details on the process are still unclear, DOE will elaborate by April 2024

- For electrolytic hydrogen, when hydrogen is produced with grid power, NPRM provides guidance how to determine the real world induced grid emissions. Proposed rules will describe how the hydrogen producer can use Energy Attribute Certificates (EAC) to claim the credit

- When EACs from low-GHG generators meet certain criteria, they can serve as reasonable proxy for calculating induced grid emissions. Proposed regulations allow EACs under three conditions:

- Electricity source must be new clean electricity – incremental to existing generation

- Electricity must be deliverable – EACs would be from sources located in the same region as the hydrogen producer

- Electricity must by time-matched or temporal – EACs would need to be matched to production on an hourly basis, but since hourly tracking systems are not yet broadly available, NPRM proposes and requests comments on a transitional rule to allow annual matching through 2027

- Public comments are strongly encouraged until 2/26/2024. Submit electronically at www.regulations.gov (indicate IRS and REG-117631-23)

In a personal reflection, back in 2001, I authored a paper that was presented at the 2001 AIChE annual meeting titled “Comparison Between Steam Reforming and Autothermal Reforming Based PEM Fuel Cell Systems” with co-authors Mark Hagan, and James Cross. At that time, our discussions centered around the potential of fuel cells and the hydrogen economy, with hopes of imminent implementation within the following decade. Now, 23 years later, we are witnessing the beginnings of this long-awaited reality.

References:

- U.S. Department of the Treasury, IRS Release Guidance on Hydrogen Production Credit to Drive American Innovation and Strengthen Energy Security. https://home.treasury.gov/news/press-releases/jy2010

- Webinar “Hydrogen Production Tax Credit”, Aaron Lang, Foley Hoag. Organized by Velerity LLC and Hydrogen Energy Center (no link available)

- Treasury Sets Out Proposed Rules for Transformative Clean Hydrogen Incentives, The White House. https://www.youtube.com/watch?v=cU70xdm2reo&t=696s